oklahoma franchise tax form

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Effective November 1 2017 corporations who remit.

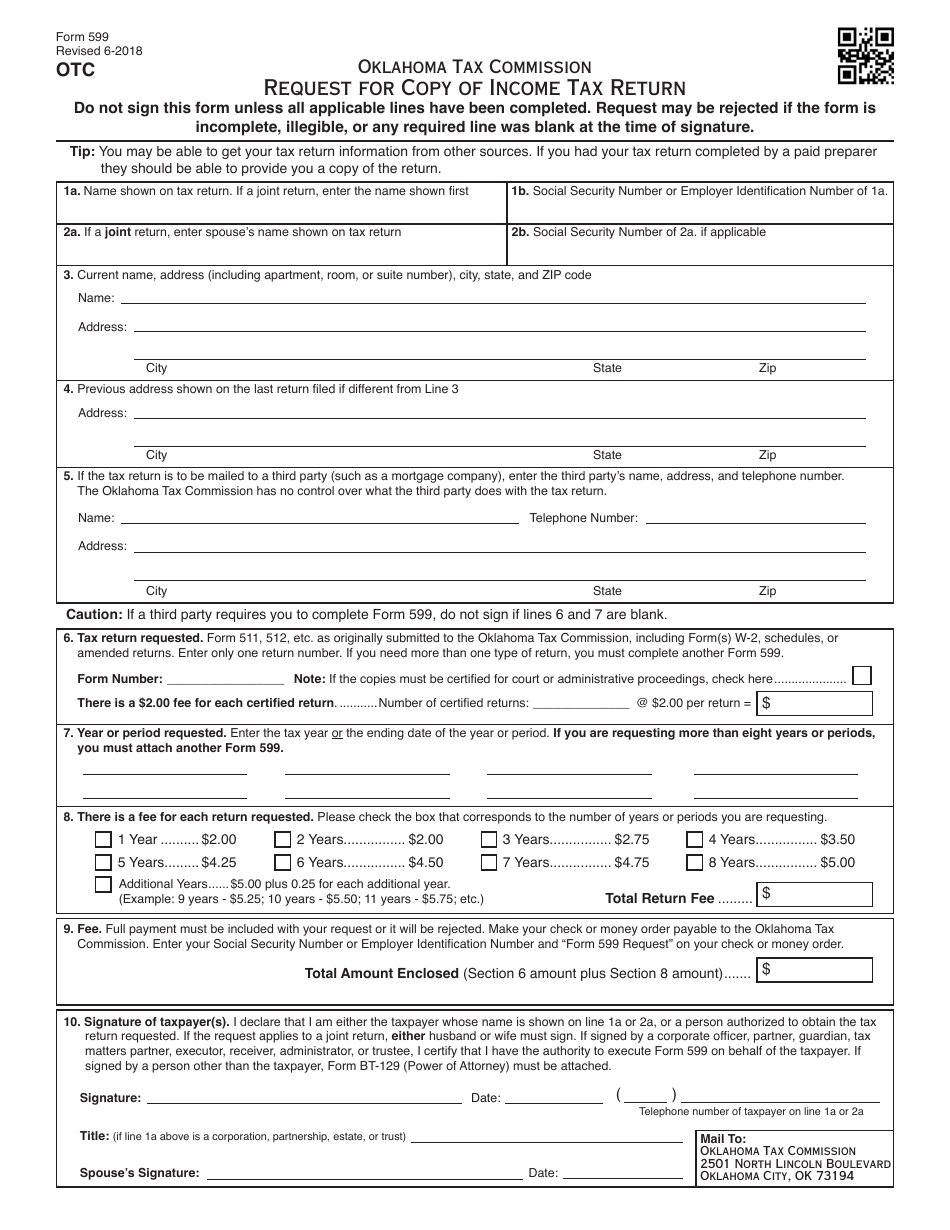

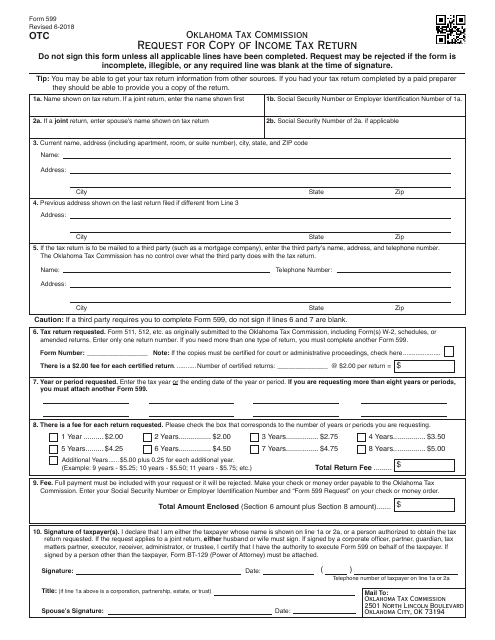

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

Franchise Tax Computation The basis for.

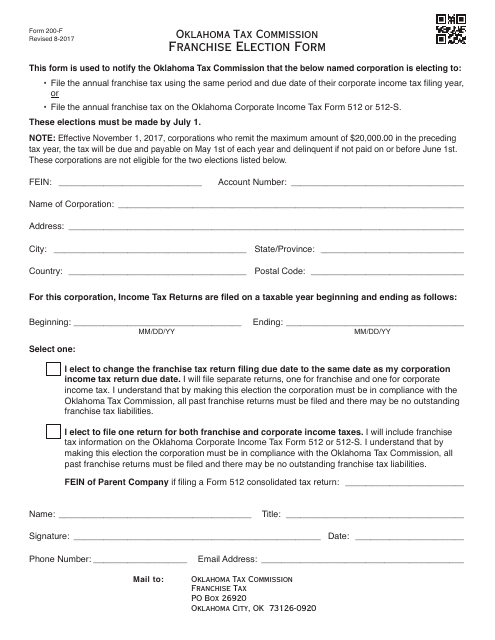

. NOT have remitted the maximum amount of franchise tax for the preceding tax year. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F. Download it from our website at wwwtaxokgov.

How is franchise tax calculated. Browse By State Alabama AL Alaska AK Arizona AZ. Corporations not filing Form.

To make this election file Form 200-F. Corporations that remitted the maximum. Complete the applicable franchise tax schedules on pages 6-9.

Use Get Formor simply click on the template preview to open it in the editor. If any of the preprinted information on this form is incorrect check item E. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. To make this election file Form 200-F. If you wish to make an election to change your filing frequency or to file using the Oklahoma Corporate Income Tax Form 512 or 512-S complete OTC Form 200-F.

Franchise Tax Payment Options New Business Information New Business Workshop. To make this election file Form 200-F. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

Quick steps to complete and e-sign Oklahoma Form Franchise Tax online. Your Oklahoma return is due 30 days. To make this election file Form 200-F.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Corporations filing a stand-alone. Mine the amount of franchise tax due.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. Corporations not filing Form.

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Start completing the fillable fields and. Change Franchise Tax Filing Period.

Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Forms - Business Taxes Forms - Income Tax Publications Exemption. These elections must be made by July 1.

You can download this form from the Oklahoma Tax Commission website wwwtaxokgov. Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax Form 512-FT-SUP Supplemental Schedule for Form 512-FT Filing date. Oklahoma Minimum Franchise Tax Form 2007-2022.

Download Oklahoma Annual Franchise Tax Return 200 Tax Commission Oklahoma form. Complete Form 512-FT Computation of Oklahoma Consolidated Annual Franchise Tax to determine the combined taxable income to report on page 2 Section Two lines 1825 of Form. Corporations not filing Form.

Franchise Tax If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

200 Oklahoma Annual Franchise Tax Return Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Franchise Tax Board Homepage Tax Franchising California State

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Franchise